Experts in Little Rock accounting explain planning ahead for tax season

Experts in Little Rock accounting explain planning ahead for tax season

Blog Article

Recognizing the Function of Audit Solutions in Effective Organization Workflow

When it comes to running a successful organization, bookkeeping solutions are greater than simply number-crunching. They shape just how you report finances, conform with tax obligation policies, and plan for future development. By comprehending these features, you can optimize capital and make notified choices. But there's more to it than fulfills the eye-- uncover how leveraging innovation can better improve your economic operations and keep your service dexterous in a constantly altering market.

The Value of Accurate Financial Reporting

When it pertains to running a successful service, precise monetary reporting is important for making notified decisions. You count on accurate data to recognize your business's monetary health and wellness, track performance, and identify fads. Without exact reports, you risk making misguided selections that can endanger growth and profitability.

Clear economic declarations help you assess capital, success, and overall security. They supply understandings into your organization's toughness and weaknesses. By frequently evaluating these reports, you can detect prospective issues early and take corrective activities.

Moreover, accurate reporting develops trust with stakeholders, consisting of financiers and lending institutions, that require dependable details before devoting their resources. It additionally ensures conformity with policies, reducing the danger of legal complications (Arkansas CPA firm). Ultimately, when you focus on exact monetary reporting, you're setting your organization up for success and allowing much better strategic planning for the future

Budgeting and Projecting for Strategic Planning

Budgeting and forecasting are crucial tools that assist you browse the complexities of critical planning. By producing a spending plan, you allocate resources properly, ensuring that every dollar is invested sensibly to fulfill your company goals. At the same time, forecasting offers insights right into future economic performance, assisting you prepare for challenges and take chances.

When you combine these two processes, you acquire a clearer image of your business's economic health. You'll be able to set sensible targets, procedure progression, and make educated choices. Routinely revisiting your budget and forecasts allows you to change to altering market conditions and interior dynamics.

Effective budgeting and forecasting also promote interaction with stakeholders, as you can offer well-supported economic strategies. In turn, this cultivates trust fund and straightens everybody towards common objectives. Ultimately, understanding these techniques settings you for lasting success and sustainability in your organization ventures.

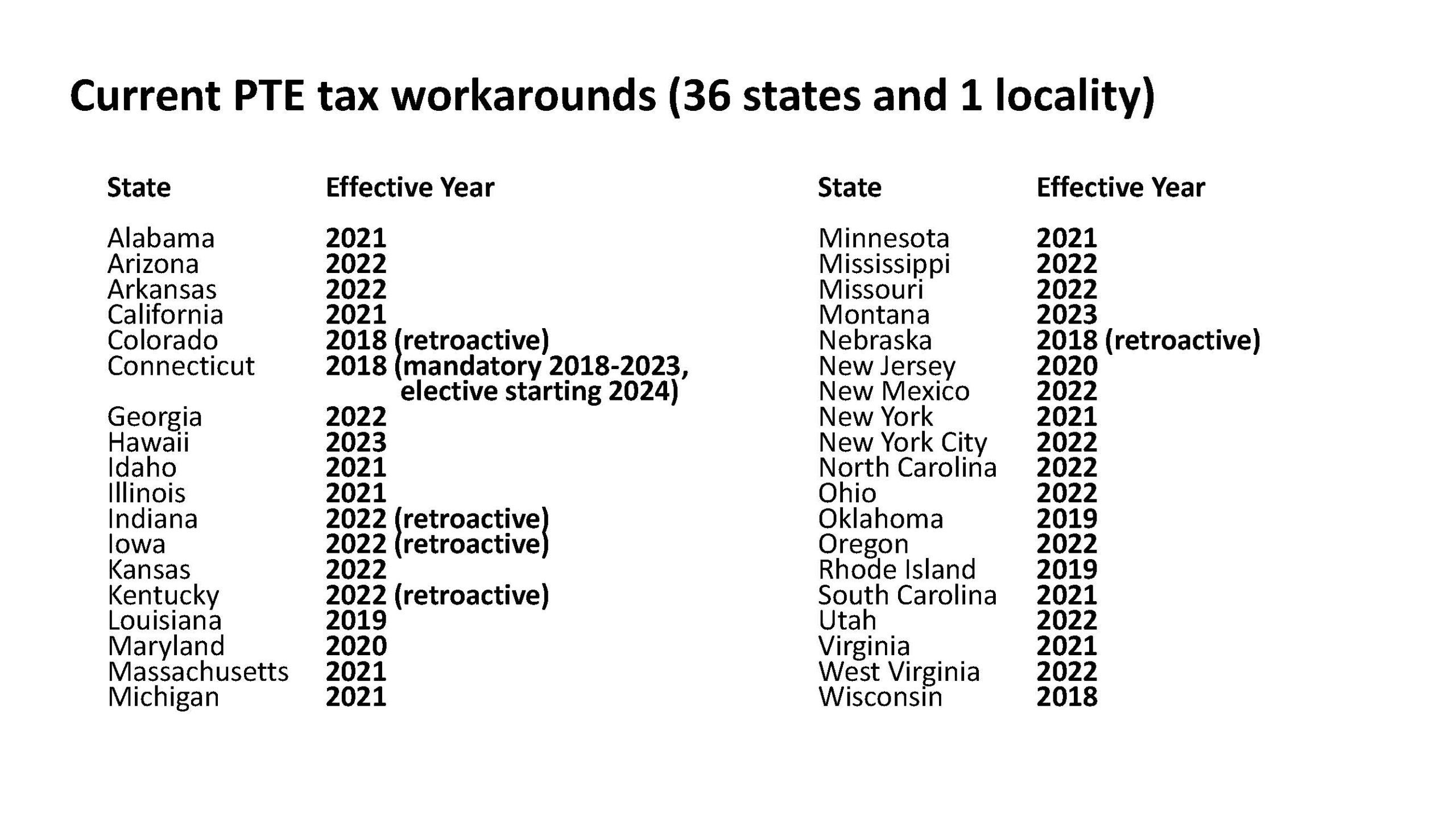

Tax Compliance and Preparation Methods

Tax compliance is essential for your business to stay clear of charges and maintain a good standing with the internal revenue service. By implementing critical tax obligation planning strategies, you can enhance your tax commitments and improve your monetary health and wellness (Frost PLLC). Allow's explore just how these methods can benefit your procedures and keep you on the appropriate side of the legislation

Value of Tax Conformity

Although several organization owners watch tax obligation conformity as a tedious responsibility, it's necessary for keeping a healthy and balanced procedure and preventing pricey penalties. Staying certified with tax guidelines not only safeguards your organization from audits however additionally develops reliability with clients and stakeholders. In addition, understanding your tax responsibilities assists you make notified monetary decisions, permitting for far better money circulation management.

Strategic Tax Obligation Planning Methods

While steering through the complexities of business procedures, it's important to execute tactical tax obligation planning strategies that align with your total financial objectives. Additionally, check out entity structuring choices that might use tax obligation benefits, like developing an LLC or S-Corp, depending on your business dimension. By taking these aggressive actions, you can enhance your business's monetary health and wellness and assurance conformity while optimizing your tax financial savings.

Capital Administration and Optimization

Grasping cash circulation management is crucial for any type of business aiming to grow. You need to maintain a close eye on the inflow and discharge of cash to guarantee you're satisfying your monetary obligations while additionally buying growth opportunities. Beginning by developing a detailed cash circulation forecast that outlines anticipated earnings and costs over a certain duration. This will certainly assist you identify prospective shortages before they end up being important issues.

Financial Evaluation for Informed Decision-Making

When you're making service decisions, financial analysis gives data-driven insights that can direct your selections. By understanding your financial metrics, you can tactically assign resources to take full advantage of efficiency and success. This technique not just enhances your decision-making process but additionally supports your general organization goals.

Data-Driven Insights

As you browse the intricacies of organization procedures, leveraging data-driven understandings through economic evaluation becomes necessary for notified decision-making. By interpreting economic data, you can determine fads, assess efficiency, and uncover chances for development. This logical approach enables you to identify locations that require enhancement, whether it's taking care of expenses or enhancing profits. Making use of tools like control panels and monetary versions, you obtain a clearer photo of your organization's health. Additionally, these insights aid you prepare for market adjustments and adjust methods as necessary. You'll discover that choosing based upon strong information not just lowers uncertainty yet additionally boosts your self-confidence in guiding your service towards success. In this data-driven era, remaining informed is your secret to a competitive side.

Strategic Source Allotment

Efficient strategic source appropriation rests on clear economic analysis, allowing you to direct your properties where they'll yield the highest possible returns. By evaluating your economic data, you can recognize patterns, area inefficiencies, and prioritize financial investments that straighten with your service objectives. This procedure aids you allocate funds to tasks or departments that show possible for development and productivity.

On a regular basis examining your monetary declarations and performance metrics guarantees you stay educated, allowing you to adapt quickly to altering market conditions. In addition, working together with bookkeeping services enhances your understanding of resource distribution, making certain you're not overlooking useful opportunities. Ultimately, clever source appropriation sustained by financial evaluation equips you to make informed choices that drive success and sustainability in your organization procedures.

Navigating Regulatory Demands and Standards

Navigating governing demands and standards can feel intimidating, especially for businesses functioning to preserve conformity while focusing on development. You need to remain informed concerning the ever-evolving rules that govern your industry. This indicates understanding local, state, and federal regulations, along with industry-specific standards.

To browse these intricacies, take into consideration working together with accounting solutions that concentrate on conformity. Frost PLLC. They can assist you analyze guidelines and execute required changes in your operations. This partnership not only assures adherence to lawful standards yet likewise assists you avoid expensive penalties

In addition, preserving accurate monetary records can improve audits and evaluations, making your procedures less difficult. Inevitably, prioritizing conformity allows you to concentrate on development while protecting your service's future.

Leveraging Technology in Accountancy Solutions

Staying compliant with regulations is simply click this link the start; leveraging modern technology can substantially enhance your audit services. By integrating cloud-based bookkeeping software, you can streamline processes, reduce mistakes, and boost data availability. This enables you to focus on strategic decision-making instead than obtaining slowed down by manual data entrance.

Automated tools can aid with invoicing, pay-roll, and expense tracking, conserving you time and making certain accuracy. Real-time economic coverage means you're always in the loop, enabling you to make enlightened decisions quickly.

In addition, using analytics devices can give useful understandings into your company efficiency, assisting you recognize patterns and chances for development.

Welcoming technology not just simplifies your accounting jobs however additionally boosts collaboration within your team. With the right tools, you can elevate your service procedures, making them extra effective and receptive to changes out there.

Often Asked Concerns

Just How Can Small Companies Take Advantage Of Accountancy Providers?

Small companies can enhance funds, guarantee conformity, and make notified choices by utilizing accountancy services. You'll conserve time, minimize mistakes, and gain understandings right into capital, assisting your business prosper and grow efficiently.

What Credentials Should I Seek in an Accounting professional?

When you're looking for an accounting professional, prioritize their certifications. Examine for relevant qualifications, experience in your sector, solid interaction abilities, and a proactive method. These factors guarantee they'll effectively fulfill your service's distinct economic demands.

Just How Often Should Organizations Evaluation Their Financial Statements?

You ought to assess your economic statements at the very least quarterly. This frequency assists you place trends, make notified decisions, and readjust your approaches as needed. Regular evaluations keep you on course with your monetary goals.

What Are the Prices Connected With Working With Audit Services?

Hiring audit services entails various costs, like per hour prices or month-to-month retainers, software program expenses, and possible training. You'll desire to review your demands and budget plan to discover the ideal equilibrium for your service.

Can Accountancy Solutions Aid With Business Growth Strategies?

Accounting services provide beneficial insights into financial health and wellness, assisting you identify growth possibilities. They enhance budgeting and forecasting, permitting you to make enlightened choices that drive your organization forward and improve general profitability.

Report this page